File a claim online.

Please choose the insurance related to

your claim

Vehicle

insurance

Property

insurance

(private persons)

Property insurance

(legal persons & pets)

Comprehensive boat insurance

Liability

insurance

Extended warranty

Accident insurance

Services

Our value proposition

Speed

Transparency

transparency

Empathy

they feel”

Simplicity

FAQ about Claim Reporting

Car

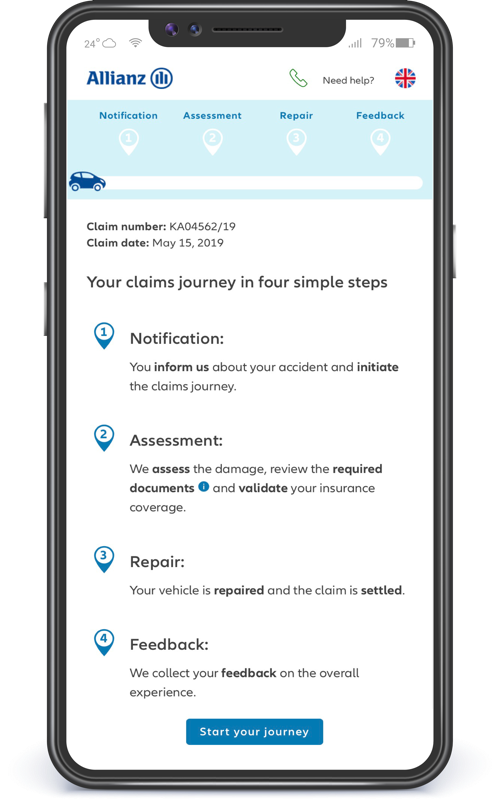

First check whether anyone has been injured and if there has been major material damage, and call the police in both cases.

If the material damage is minor, photograph the vehicles at the scene of the accident, remove them from the road and complete the European Accident Report. We will request a statement from our insured person separately.

- Report the damage using the online form and a few minutes after the report, we will send you a link to monitor the status of your damage using the online application “Online Claims Tracker”.

- Take photos of the vehicle according to the instructions in the application and upload them in the app together with, driver's license and the European Accident Report.

- We will contact you back within two hours within business hours and provide you with a statement of damages and a settlement proposal to resolve your claim. If you want to repair the vehicle at a service facility, the list of our contractual partners can be found at thelink: Car services, and after the repair, we will pay the amount for the service repair, noting that the invoice must be in accordance with the damage report. In the case of major damage that requires our assessment, colleagues will contact you as soon as possible to agree on a date for the assessment of damage.

- Report the damage using the online form and a few minutes after the report, we will send you a link to monitor the status of your damage using the online application “Online Claims Tracker”.

- Take photos of the vehicle according to the instructions in the application and upload them in the app.

- We will contact you back within two hours within business hours and provide you with a statement of damages and a settlement proposal to resolve your claim. If you want to repair the vehicle at a service facility, the list of our contractual partners can be found at thelink: Car services, and after the repair, we will pay the amount for the service repair, noting that the invoice must be in accordance with the damage report. In the case of major damage that requires our assessment, colleagues will contact you as soon as possible to agree on a date for the assessment of damage.

When handling claims, we focus on solutions that protect both the environment and your time. That’s why we prefer repairing your vehicle’s parts instead of replacing them whenever possible.

By choosing repairs, we help to:

- Cut down on waste – fewer discarded materials

- Reduce CO₂ emissions – saving energy and resources by avoiding the production of new parts

- Save you time and money – repairs are quicker and more cost-effective than replacements

Property (Buildings, Movable Property)

First, do everything you can to prevent further damage.

- Report the damage using the online form and a few minutes after the report, we will send you a link to monitor the status of your damage using the online application “Online Claims Tracker”.

- Take photos of the damaged object and objects according to the instructions and upload the photos in the app.

- We will contact you back within 2 hours within business hours and provide you with a statement of damages. In the case of major damage that requires our assessment, colleagues will contact you as soon as possible to agree on a date for the assessment of damage. If there is damage to household appliances, please provide us with a service report that identifies the type of damage to the device.

In case of a theft, fire, robbery or vandalism after burglary, or in case of burglary, fire, robbery or vandalism after theft, provide us with:

- a certificate from the competent Ministry of the Interior regarding the harmful event;

- specification of the claim (list of stolen/damaged items, brand, type, quantity, year of production, etc.);

- invoices for the purchase of the stolen items or warranty cards.

Accident

If an accident occurs in which an injury has occurred, contact your doctor immediately for an examination and to provide the necessary assistance. Follow the medical advice and instructions on treatment and rehabilitation. Send us:

- A copy of the entire medical documentation related to the treatment of the consequences of the accident

- Certificate from the school/employer if the insured are students/employees of an institution according to the records of the policyholder

- Proof of the occurrence of the accident (record of the inspection, driver's and traffic license, record of alcohol testing/analysis of blood and urine for alcohol, report of injury at work, etc.).

Life assurance

In the event of a death, the death of the insured person may be reported by the beneficiaries under the insurance policy, i.e. the legal heirs, and it is necessary to submit:

- Certificate from the school/employer if the insured are students/employees of an institution according to the records of the policyholder

- Proof of kinship (decision on inheritance, marriage certificate, birth certificate, decision of the guardianship authority)

- Coroner's report (Death certificate/autopsy report) showing the cause of death

- Death certificate

- Proof of the occurrence of the insured event in the event of death due to an accident (record of the inspection, analysis of blood and urine for alcohol, copy of driver's license, copy of traffic license, etc.).

Allianz global customer satisfaction rating

4.4 star rating out of 54.4/5

3324 Reviews

That's what clients said about us

Claims processing satisfaction